maricopa county irs tax liens

Office Location 301 West Jefferson Suite 100 Phoenix Arizona 85003. If payments are not made to the county treasurer in a timely manner they become delinquent incurring interest and fees each month they remain unpaid.

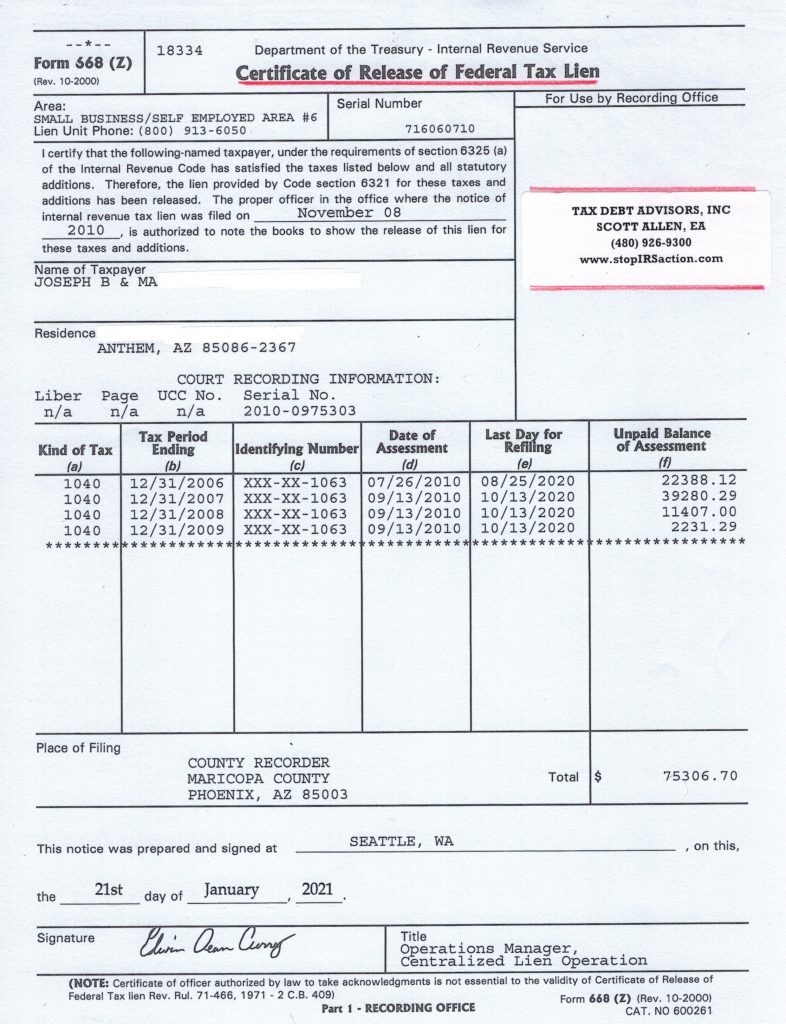

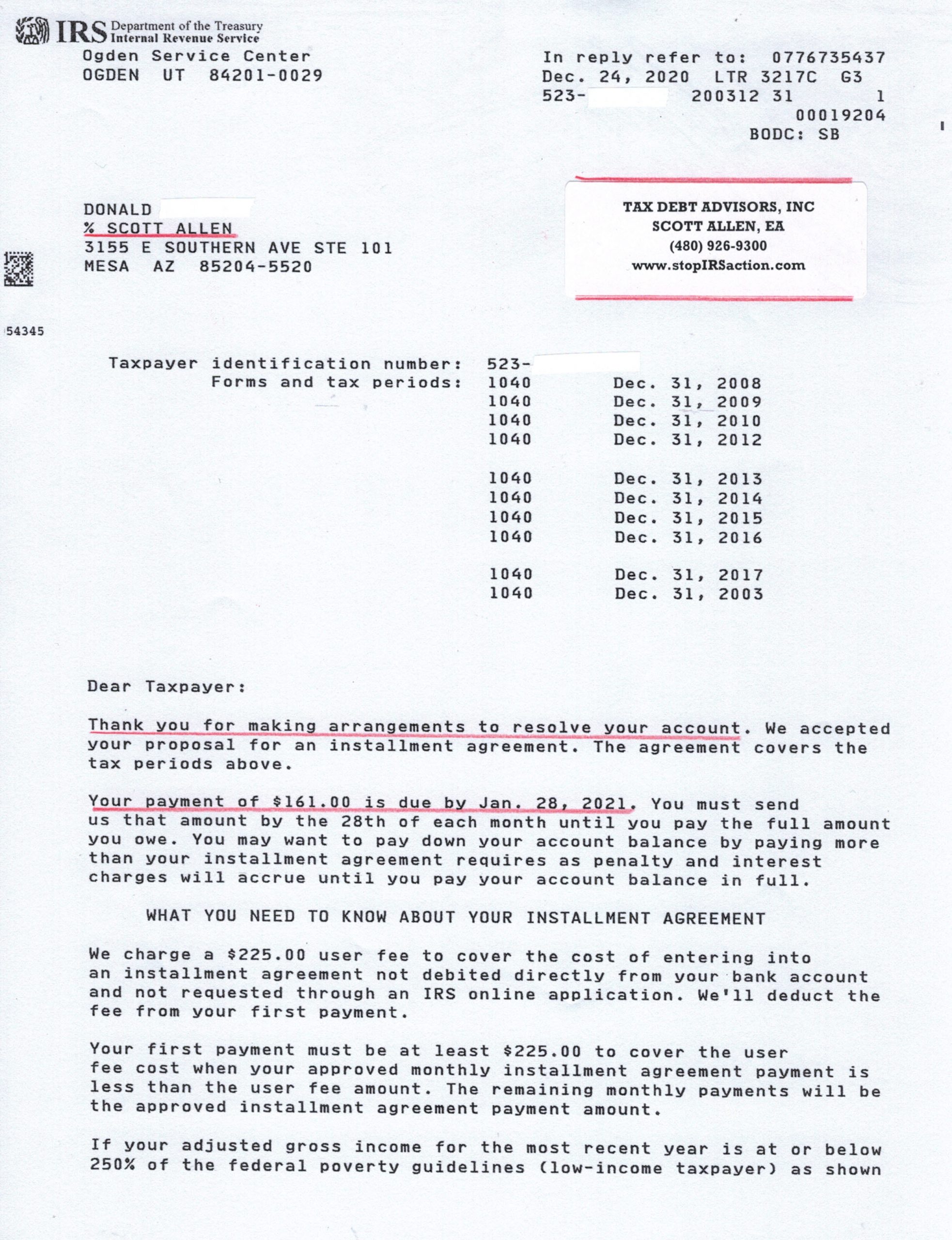

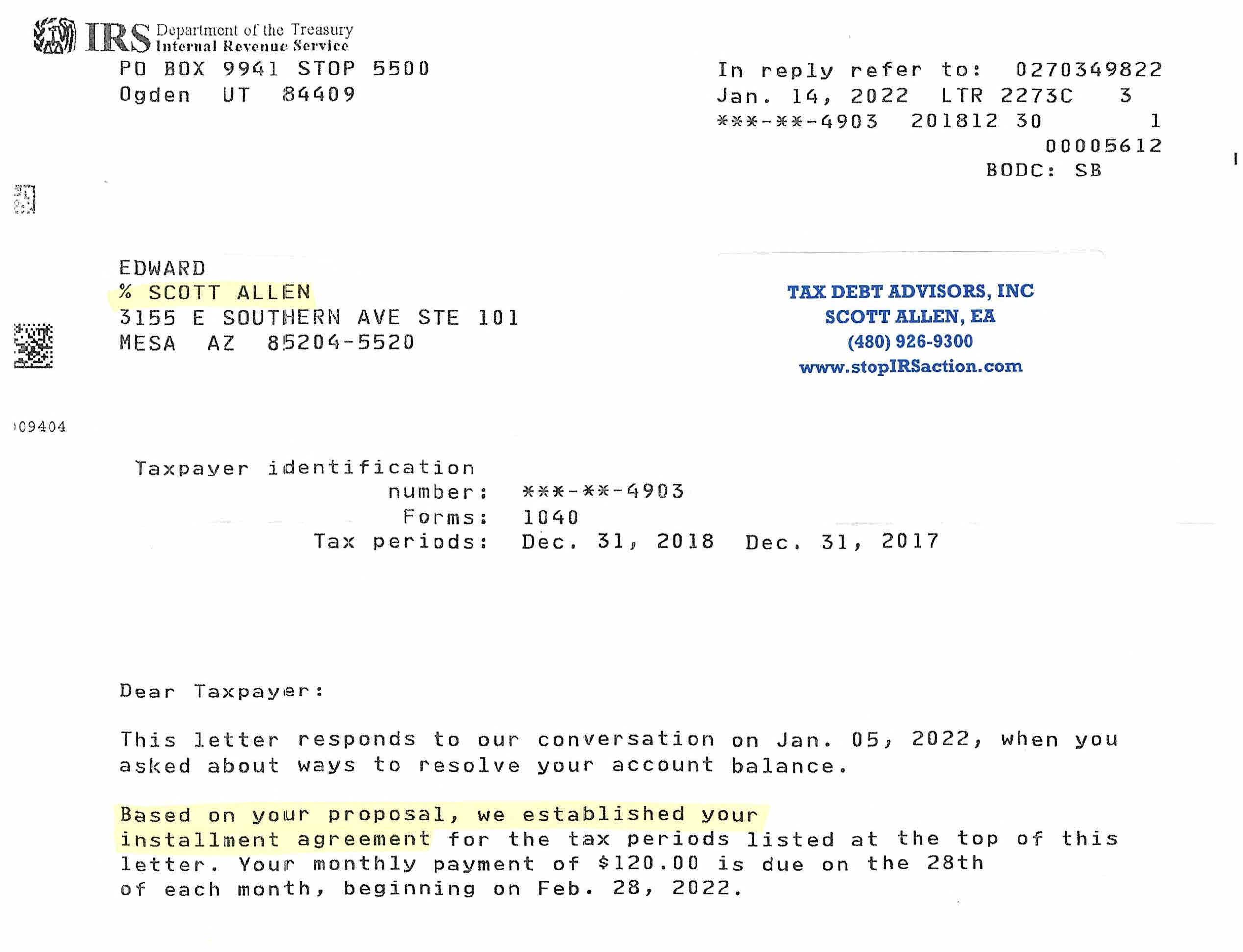

Irs Tax Lien In Arizona Irs Help From Tax Debt Advisors Inc Tax Debt Advisors

Parcels With Overdue Taxes.

. Treasurers - 1871 to Present. This lien is a public claim for the outstanding delinquent tax meaning the property cannot be transferred or sold. In certain municipalities the treasurers office will eventually place a property tax lien on the property.

Understanding Your Tax Bill.

An Interview With The Maricopa County Treasurer Asreb

Maricopa County Treasurer S Office John M Allen Treasurer

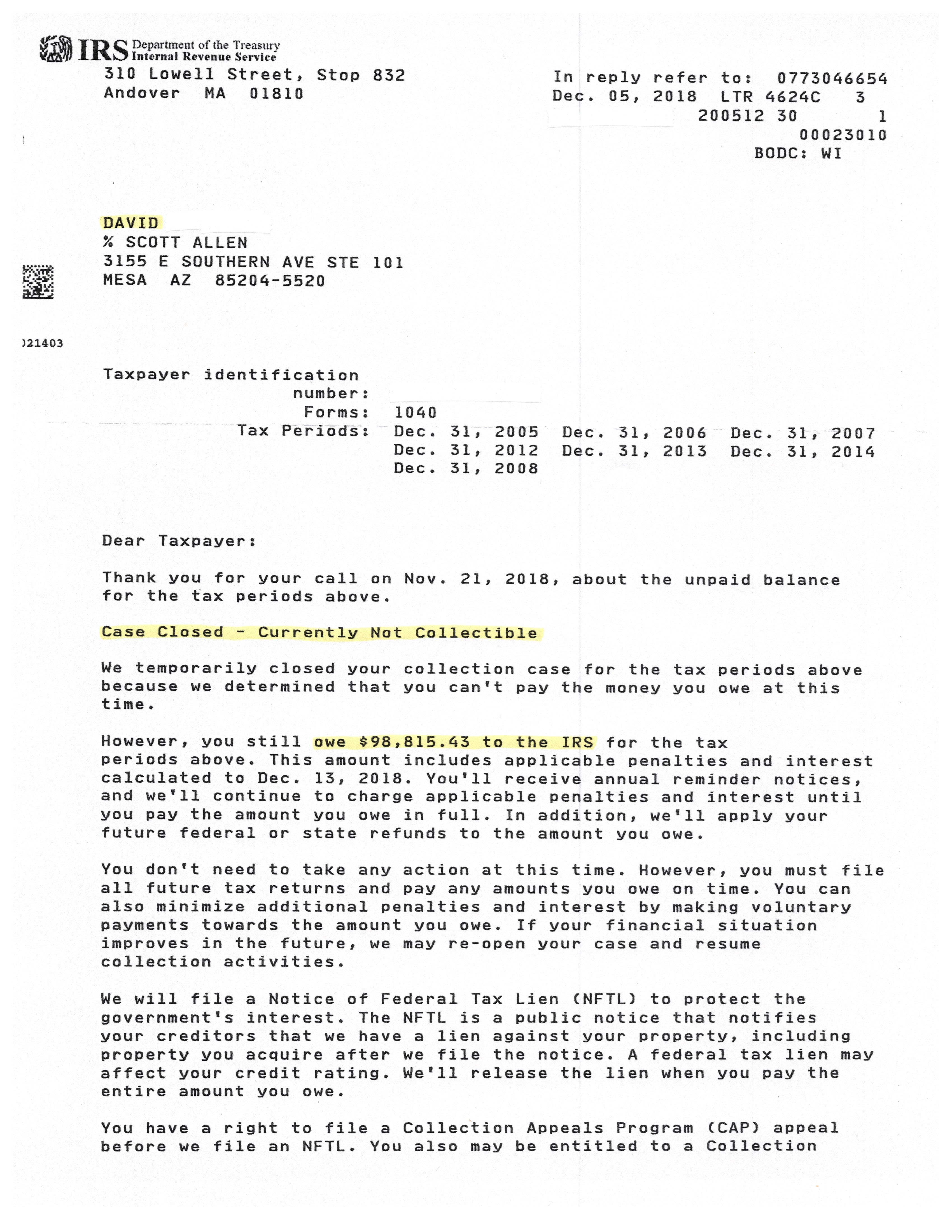

Irs Tax Lien Problems Tax Debt Advisors

Maricopa County Treasurer S Office John M Allen Treasurer

An Interview With The Maricopa County Treasurer Asreb

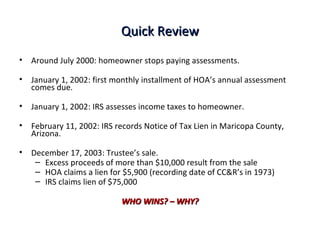

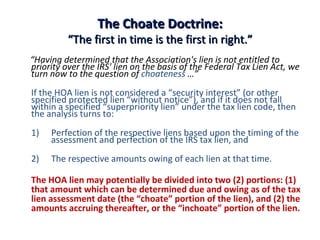

Tax Liens Tax Lien Foreclosures Arizona School Of Real Estate And Business

Hoa And Irs Lien Priority Issues

Irs Tax Lien Problems Tax Debt Advisors

Hoa And Irs Lien Priority Issues

Irs Tax Payment Plan Tax Debt Advisors

Irs Tax Lien Problems Tax Debt Advisors

Maricopa County Treasurer S Office John M Allen Treasurer

Delinquent Property Tax Lien Sale Overview Arizona School Of Real Estate And Business